Public sector debt reached a new high of £2.08 trillion at the end of October after Government borrowing hit a record £22.3 billion last month, according to official figures.

October borrowing, excluding state-owned banks, was lower than forecast by economists, but still marks the highest October level since records began in 1993 and a £10.8 billion increase year-on-year.

The Office for National Statistics (ONS) said borrowing for the first seven months of the financial year is now estimated at £214.9 billion – the highest in any April to October period on record.

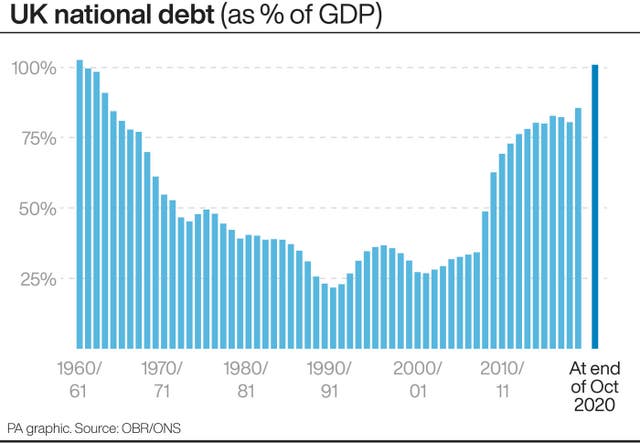

It means the UK’s overall debt has reached around 100.8% of gross domestic product (GDP) – a level not seen since the early 1960s – as the Government has spent more than £200 billion supporting the economy through the pandemic.

Experts said it leaves the Chancellor facing a difficult balancing act ahead of his spending review on November 25, with Brexit also looming at the end of the year.

Rishi Sunak stressed the UK’s public finances would need to be put on a “sustainable path” over time.

He said: “We’ve provided over £200 billion of support to protect the economy, lives and livelihoods from the significant and far-reaching impacts of coronavirus.

“This is the responsible thing to do, but it’s also clear that over time it’s right we ensure the public finances are put on a sustainable path.”

Public sector net borrowing was £214.9 billion in the financial year-to-date (April to October 2020)

This is £169.1 billion more than during the same time last year and more than in any April to October period since current records began in 1993 https://t.co/YiD2xAR7q2 pic.twitter.com/P6uzysq3m6

— Office for National Statistics (ONS) (@ONS) November 20, 2020

The figures come amid reports Mr Sunak will use next week’s spending review to limit pay rises for five million public sector workers to help rebuild the public finances.

It is thought he will cap pay rises in the public sector to at or below inflation, though frontline NHS doctors and nurses will likely be exempt from the cap in recognition of their work during the coronavirus pandemic.

The spending review will be accompanied by the latest economic and fiscal forecasts by the Office for Budget Responsibility (OBR).

While borrowing in the financial year so far has been less than predicted by the fiscal watchdog, it is still thought to be on track to come near its full financial year forecast of £372.2 billion by the end of March 2021.

Samuel Tombs at Pantheon Macroeconomics said: “The borrowing undershoot is attributable almost entirely to tax receipts in the year-to-date exceeding its forecast by £71.4 billion, due to the higher path for GDP in the second quarter and third quarter than the OBR anticipated.”

He added the borrowing trend will “deteriorate in the winter and the OBR won’t revise down its borrowing forecast next week”.

The ONS data showed Government tax revenues were £39.7 billion last month, down £2.7 billion year-on-year as the pandemic saw falls in VAT, business rates and Pay As You Earn (PAYE) income tax.

Government spending on day-to-day activities rose to £71.3 billion, up £6.4 billion on a year earlier, including £1.3 billion on the furlough scheme and £300 million in Self Employment Income Support Scheme (SEISS) payments.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here